Hmrc Double Taxation Address . john is trying to fill out the form “double taxation: • deducting any earnings and tax stated below in arriving at the amounts entered in boxes 1 and 2 of the employment page. if you are dual resident and want to make a claim, you should use form hs302, ‘dual residents’. applications for relief at source and claims to repayment of uk withholding tax may be made to the hmrc double. Send a general residence enquiry. purpose of form france individual dt. send an enquiry about uk allowances or double taxation agreements. if your procedure is to send the form direct to the uk taxation authority, the address to which to send it is: Form france individual dt allows you to apply under the uk/france double taxation.

from osome.com

purpose of form france individual dt. • deducting any earnings and tax stated below in arriving at the amounts entered in boxes 1 and 2 of the employment page. if your procedure is to send the form direct to the uk taxation authority, the address to which to send it is: if you are dual resident and want to make a claim, you should use form hs302, ‘dual residents’. send an enquiry about uk allowances or double taxation agreements. john is trying to fill out the form “double taxation: Form france individual dt allows you to apply under the uk/france double taxation. applications for relief at source and claims to repayment of uk withholding tax may be made to the hmrc double. Send a general residence enquiry.

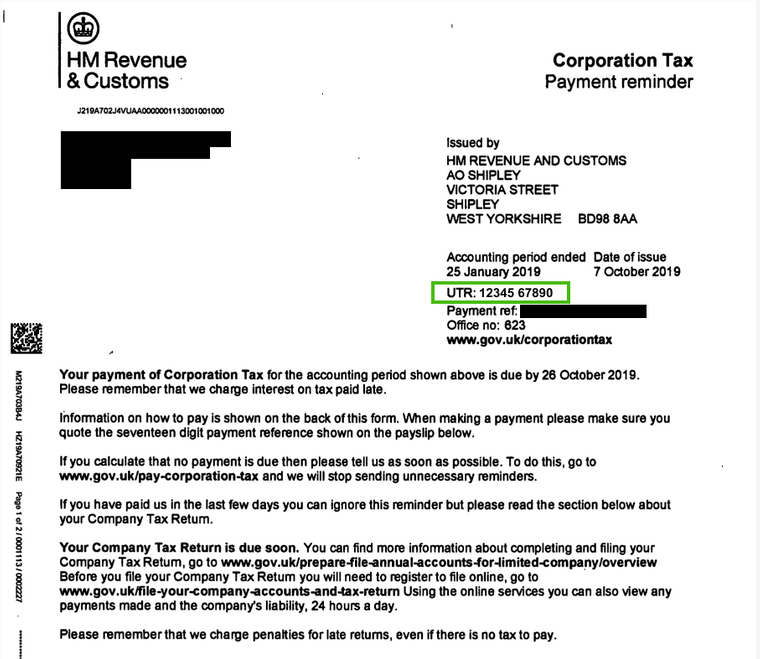

Everything You Need To Know About Tax Reference Numbers

Hmrc Double Taxation Address send an enquiry about uk allowances or double taxation agreements. Send a general residence enquiry. Form france individual dt allows you to apply under the uk/france double taxation. john is trying to fill out the form “double taxation: if you are dual resident and want to make a claim, you should use form hs302, ‘dual residents’. send an enquiry about uk allowances or double taxation agreements. purpose of form france individual dt. if your procedure is to send the form direct to the uk taxation authority, the address to which to send it is: • deducting any earnings and tax stated below in arriving at the amounts entered in boxes 1 and 2 of the employment page. applications for relief at source and claims to repayment of uk withholding tax may be made to the hmrc double.

From www.lancingcotswold.com

Everything You Need To Know About an HMRC Tax Investigation Hmrc Double Taxation Address john is trying to fill out the form “double taxation: send an enquiry about uk allowances or double taxation agreements. if your procedure is to send the form direct to the uk taxation authority, the address to which to send it is: purpose of form france individual dt. if you are dual resident and want. Hmrc Double Taxation Address.

From bhuonlwasune.blogspot.com

The Best 26 Hmrc Tax Contact Number bhuonlwasune Hmrc Double Taxation Address Send a general residence enquiry. if your procedure is to send the form direct to the uk taxation authority, the address to which to send it is: Form france individual dt allows you to apply under the uk/france double taxation. purpose of form france individual dt. send an enquiry about uk allowances or double taxation agreements. . Hmrc Double Taxation Address.

From www.alamy.com

Hmrc Tax High Resolution Stock Photography and Images Alamy Hmrc Double Taxation Address Send a general residence enquiry. purpose of form france individual dt. applications for relief at source and claims to repayment of uk withholding tax may be made to the hmrc double. if you are dual resident and want to make a claim, you should use form hs302, ‘dual residents’. if your procedure is to send the. Hmrc Double Taxation Address.

From www.pdffiller.com

20222024 Form UK HMRC SA108 Fill Online, Printable, Fillable, Blank Hmrc Double Taxation Address Send a general residence enquiry. • deducting any earnings and tax stated below in arriving at the amounts entered in boxes 1 and 2 of the employment page. if your procedure is to send the form direct to the uk taxation authority, the address to which to send it is: applications for relief at source and claims to. Hmrc Double Taxation Address.

From www.youtube.com

How to pay UK corporation tax to HMRC YouTube Hmrc Double Taxation Address • deducting any earnings and tax stated below in arriving at the amounts entered in boxes 1 and 2 of the employment page. send an enquiry about uk allowances or double taxation agreements. purpose of form france individual dt. if your procedure is to send the form direct to the uk taxation authority, the address to which. Hmrc Double Taxation Address.

From www.informdirect.co.uk

How to tell HMRC a new company is dormant Hmrc Double Taxation Address applications for relief at source and claims to repayment of uk withholding tax may be made to the hmrc double. if your procedure is to send the form direct to the uk taxation authority, the address to which to send it is: send an enquiry about uk allowances or double taxation agreements. john is trying to. Hmrc Double Taxation Address.

From www.researchgate.net

Example of Official HM Revenue and Customs' (HMRC) Annual Tax Summary Hmrc Double Taxation Address john is trying to fill out the form “double taxation: if you are dual resident and want to make a claim, you should use form hs302, ‘dual residents’. purpose of form france individual dt. Form france individual dt allows you to apply under the uk/france double taxation. applications for relief at source and claims to repayment. Hmrc Double Taxation Address.

From businessadviceservices.co.uk

Sample HMRC letters Business Advice Services Hmrc Double Taxation Address john is trying to fill out the form “double taxation: • deducting any earnings and tax stated below in arriving at the amounts entered in boxes 1 and 2 of the employment page. Send a general residence enquiry. if your procedure is to send the form direct to the uk taxation authority, the address to which to send. Hmrc Double Taxation Address.

From mcl.accountants

Letter from HMRC about Overseas Assets, or Gains Hmrc Double Taxation Address john is trying to fill out the form “double taxation: applications for relief at source and claims to repayment of uk withholding tax may be made to the hmrc double. purpose of form france individual dt. • deducting any earnings and tax stated below in arriving at the amounts entered in boxes 1 and 2 of the. Hmrc Double Taxation Address.

From www.loveaccountancy.co.uk

How to print your SA302 or Tax Year Overview from HMRC Love Hmrc Double Taxation Address purpose of form france individual dt. if your procedure is to send the form direct to the uk taxation authority, the address to which to send it is: john is trying to fill out the form “double taxation: applications for relief at source and claims to repayment of uk withholding tax may be made to the. Hmrc Double Taxation Address.

From www.abacni.co.uk

What is HMRC'S personal tax account? ABAC Accountants Hmrc Double Taxation Address Form france individual dt allows you to apply under the uk/france double taxation. • deducting any earnings and tax stated below in arriving at the amounts entered in boxes 1 and 2 of the employment page. purpose of form france individual dt. john is trying to fill out the form “double taxation: applications for relief at source. Hmrc Double Taxation Address.

From businessadviceservices.co.uk

Sample HMRC Letters Business Advice Services Hmrc Double Taxation Address if your procedure is to send the form direct to the uk taxation authority, the address to which to send it is: Form france individual dt allows you to apply under the uk/france double taxation. if you are dual resident and want to make a claim, you should use form hs302, ‘dual residents’. send an enquiry about. Hmrc Double Taxation Address.

From www.citizensadvice.org.es

Statement HMRC Re Dual Taxation And Government Pension Citizens Hmrc Double Taxation Address Send a general residence enquiry. Form france individual dt allows you to apply under the uk/france double taxation. purpose of form france individual dt. applications for relief at source and claims to repayment of uk withholding tax may be made to the hmrc double. john is trying to fill out the form “double taxation: if your. Hmrc Double Taxation Address.

From www.youtube.com

Episode 15 Fowler v HMRC implications for the interpretation of Hmrc Double Taxation Address if you are dual resident and want to make a claim, you should use form hs302, ‘dual residents’. send an enquiry about uk allowances or double taxation agreements. john is trying to fill out the form “double taxation: applications for relief at source and claims to repayment of uk withholding tax may be made to the. Hmrc Double Taxation Address.

From www.goforma.com

How to contact HMRC HMRC Support Hmrc Double Taxation Address if your procedure is to send the form direct to the uk taxation authority, the address to which to send it is: john is trying to fill out the form “double taxation: if you are dual resident and want to make a claim, you should use form hs302, ‘dual residents’. Form france individual dt allows you to. Hmrc Double Taxation Address.

From www.pdffiller.com

Fillable Online hmrc gov hmrc wtt1 form Fax Email Print pdfFiller Hmrc Double Taxation Address if you are dual resident and want to make a claim, you should use form hs302, ‘dual residents’. applications for relief at source and claims to repayment of uk withholding tax may be made to the hmrc double. Send a general residence enquiry. purpose of form france individual dt. Form france individual dt allows you to apply. Hmrc Double Taxation Address.

From www.ukpropertyaccountants.co.uk

A Complete Guide to ShortTerm Property Letting Hmrc Double Taxation Address Send a general residence enquiry. Form france individual dt allows you to apply under the uk/france double taxation. if you are dual resident and want to make a claim, you should use form hs302, ‘dual residents’. john is trying to fill out the form “double taxation: if your procedure is to send the form direct to the. Hmrc Double Taxation Address.

From www.zest.tax

HMRC Enquiries and Compliance Checks A Comprehensive Guide for R&D Tax Hmrc Double Taxation Address purpose of form france individual dt. Send a general residence enquiry. if your procedure is to send the form direct to the uk taxation authority, the address to which to send it is: • deducting any earnings and tax stated below in arriving at the amounts entered in boxes 1 and 2 of the employment page. applications. Hmrc Double Taxation Address.